知海資訊

zhihai news

波羅的海交易所數據顯示,2018年,全球遠期運費協議(FFA)交易量實現增長。油船市場運費衍生品交易額同比增長20%;干散貨市場運費衍生品交易額同比增長1.4%,創下金融危機以來的最好記錄,其中干散貨運價期權交易額同比大增44%。

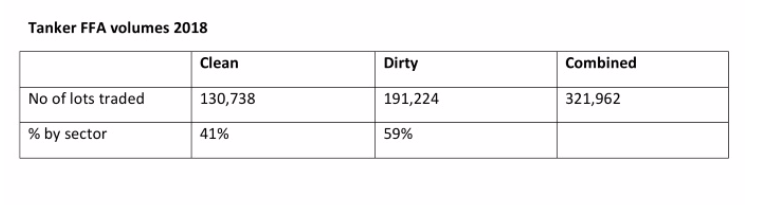

Figures compiled by the Baltic Exchange reveal that the overall volume of Forward Freight Agreement (FFA) trades increased in 2018. Freight derivative volumes in the tanker market rose by 20% in 2018 hitting 321,962 lots, volumes in the dry market rose 1.4% to 1,196,929 lots, its strongest performance since 2008, while dry options volumes rose by 44% to 268,976 lots, finding similar levels to 2016. One lot is defined as a day’s hire of a vessel or 1000 metric tonnes of ocean transportation of cargo.

Closer analysis of the figures reveals that on the dry bulk side panamax volumes grew by 10% and now account for nearly half (48%) of all dry FFA trades. Capesize volumes were down slightly on 2017, dropping 4.5% to 481,725 lots.

For dry options, panamax volumes grew by 65% to 82,987 lots, now accounting for nearly a third (31%) of all trades, with capesize volumes improving 37% to 182,575 lots to take a 68% share of the total. Supramax lots were down 3.5% (3,414 lots) on 2017 levels, accounting for the final 1% of the 2018 total.

Open dry interest stood at 207,891 lots on 2 January 2019, up 25% on 2 January 2018. Dry option open interest is also up with 185,724 lots open on 2 January 2019, up 57% on 2 January 2018.

For tankers, dirty trade volumes were up 53% on the previous year reaching 191,224 lots. Much of this growth took place in the final quarter of 2018 when an average of 5691 lots were traded each week. Clean volumes for the year were down 10% at 130,738 lots.

Open interest for tankers stood at 50,962 lots on 2 January 2019.